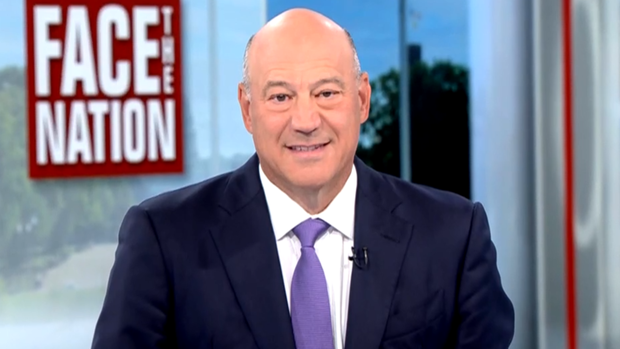

IBM vice chairman Gary Cohn, who served as former President Trump’s chief economic adviser from 2017 to 2018 and was a director of the National Economic Council, said Sunday that tariffs such as the plan proposed by the former president can lead to inflation if the approach isn’t “methodical.”

The economy remains a top issue for voters as the Nov. 5 presidential election draws closer. The issue also held a front row seat at the Sept. 10 presidential debate as both Trump and Vice President Kamala Harris laid out their plans for the economy. Harris says she’d provide bigger tax benefits for families but would offset the costs by raising corporate taxes, while Trump has said he’d extend the tax cuts enacted in 2017.

Trump’s proposed economic plan also includes blanket tariffs on all imports into the United States, including a 60% tariff on imports from China and a 10% tariff on imports from other nations. The former president doubled down on these proposals last week during the presidential debate.

“Other countries are going to, finally, after 75 years, pay us back for all that we’ve done for the world,” he said.

CBS News

Republican vice-presidential nominee Sen. JD Vance also spoke to Trump’s tariff plan Sunday on Face the Nation.

“We want American workers to get tax cuts under President Trump’s policies, and we want to actually penalize companies that are shipping jobs overseas through tariffs,” Vance said. “We should not be allowing slave laborers to benefit from American markets. If you want access to our market, you’ve got to pay our workers fair wages.”

On paper, the proposed tariff hike could cover the cost of tax cuts, which are a cornerstone in Trump’s campaign pledge to end the “inflation nightmare.” But some experts have warned that Trump’s economic policies could stall, or even reverse, progress. They note that tariffs effectively act as a consumption tax, increasing the cost of imported goods into the U.S. which consumers usually feel the weight of on their receipts.

Cohn said Sunday that he finds it “completely reasonable” for the U.S. government to tariff Chinese imports on products the U.S. also produces, like electric vehicles, which the Biden administration announced plans for in May. But he also noted that he does not see the value of tariffs on imports of products that are not manufactured in the U.S.

“We import many products that we do not produce in this country. Those products are in high demand, and we need them. A lot of them are pharmaceuticals, many other products that we expect to have on our shelves when we go in the store,” Cohn said. “If we start tariffing those products, we will have inflation. To the extent that we want to produce those products in this country, we should start out on a very methodical path to do that.”

The former Trump adviser then cited the CHIPS and Science Act as a competitive approach that was “done pretty reasonably.” The CHIPS Act funds the domestic production of semiconductors, and was developed by the Trump administration before being signed into law by President Biden in 2023.

“So we can build chips here, and then we can become self-sufficient on chip manufacturing,” Cohn said. “Then we can tariff foreign chips from flooding our market at a discount price, but until we have the capacity to build them ourselves, putting a tariff on those chips would just be debilitating to our economy.”

As both presidential candidates continue to campaign their economic agendas, the United States Federal Reserve this week is expected to announce its first interest rate cut in over four years since 2020.

Economists told CBS News that Trump’s plans for tax cuts would act as an inflationary fiscal stimulus and that his plans for deporting immigrants could force employers to pay higher wages. In that case, the Fed could be forced to keep its benchmark rate higher for longer.

If consumers “are upset now, they will be hopping mad a year from now” regarding inflation if Trump wins and implements his policies, Mark Zandi, chief economist of Moody’s Analytics and co-author of a June report on the macroeconomic impacts of either a Trump or Biden win in November, told CBS News.